General Ledger: How to apply, capture and process Customer and Supplier Settlement Discounts in Cashbook Batch payments and deposits

Summary

Learn how to apply, capture, and process Customer and Supplier Settlement Discounts in Cashbook Batch payments and deposits, in Sage 200 Evolution:

Description

This article explains how to apply, capture, and process Customer and Supplier Settlement Discounts in Cashbook Batch payments and deposits.

Resolution

Consider the following advice to achieve the above outcome:

To explain further, we’ll use the following scenario for a Customer Invoice and how it’s paid.

A. Invoice and Discount Background

The total customer invoice amount is R6 150. However, a discount of 2.5% has been granted to the customer if they pay within a certain period of the invoice date (Settlement Discount).

Therefore, the customer owes you the following amount (if the invoice is paid on or before the Settlement Date)

= R6 150 x 2.5%

= R153.75

= R6 150 – R153.75

= R5 996.25

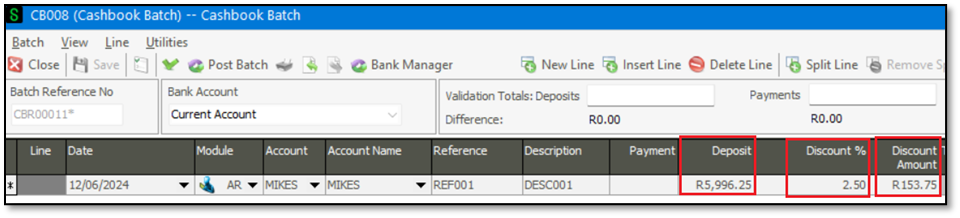

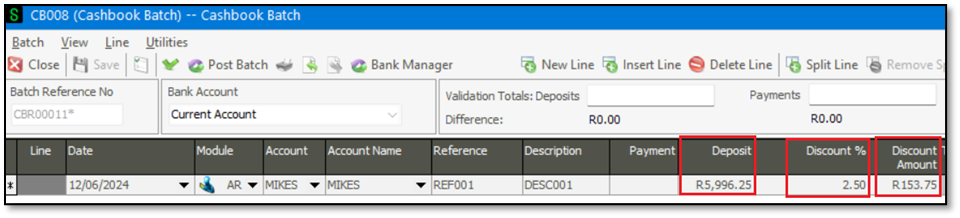

B. Discount application in Cashbook Batch

The Customer paid the invoice amount of R5 996.25 before the Settlement Date.

Therefore, enter the following values on the Cashbook Batch:

- Deposit: R5 996.25 (Total amount as received from the Customer)

- Discount %: 2.5% (Discount amount granted to Customer)

Notice that the correct Discount Amount of R153.75 is automatically calculated, as a result.

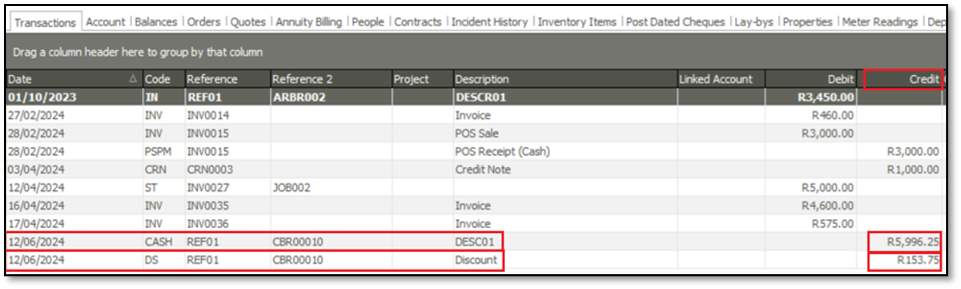

C. Customer Enquiries screen

After posting the Cashbook Batch, note the following transaction history for the above customer on the Customer Enquiries screen.

Two separate transaction lines (and amounts) are updated above for the single Cashbook batch transaction line (see above).

The separation is required for the following reason:

The full Invoice amount ( R6 150) can be fully allocated against the deposit amount ( R5 996.25 ) and discount amount (R153.75).

D. Manual calculation of the Discount Amount

To manually calculate the above discount amount of R153.75, consider the following advice:

Phase 1: Determine what amount represents 100% (total Invoice amount)

In this case:

R5 996.25 represents 97.5% of the total Invoice amount.

Therefore, 1% is represented by:

Deposit Amount / (100 – Discount %)

= 5 996.25/(100-2.5)

= 61.5

Therefore 100% is represented by an amount of (61.5 x 100)

= R6 150 (this also equals the total Invoice amount)

Phase 2: Final Discount Amount Calculation

Discount Amount = 100% Amount x Entered Discount %

= R6150 x 2.5%

= R153.75 (corresponds with the Discount Amount above).