Inventory: Inserting/including an Inventory Valuation reduction column based on Inventory Item’s Unit Cost for Sales Invoices on Inventory Transactions report

Summary

Learn how to insert/include an Inventory Valuation reduction column based on the Inventory Item’s Unit Cost, for Sales Invoices on Inventory Transactions report, in Sage 200 Evolution.

Description

The standard Inventory Transactions report does not have a column to reveal the reduction in Inventory Valuation based on the Unit Cost of stock items used in a Sales Invoice.

This article therefore discusses a customised Inventory Transaction report layout that includes the above-mentioned column.

Resolution

1. Rename it to Inventory Transactions New.rtm

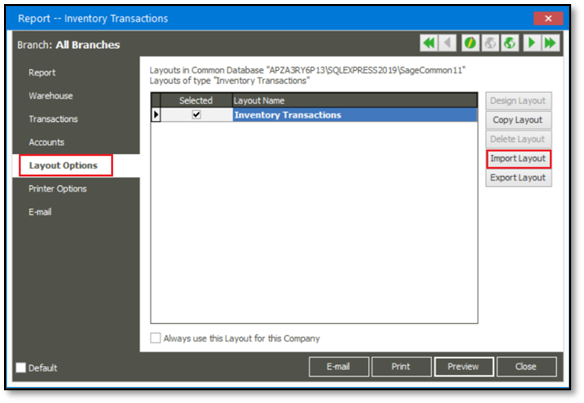

2. Go to Inventory | Reports | Transactions and open it

3. Open the Layout Options tab

4. Click the Import Layout button and browse for the Inventory Transactions New.rtm file

5. Give it a new unique name as part of importing.

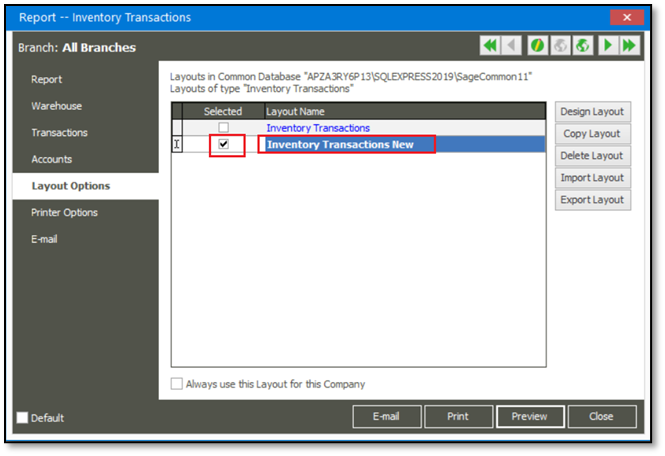

When done, it should be listed as below.

6. Select the new layout on the Selected option box to be used as the new default.

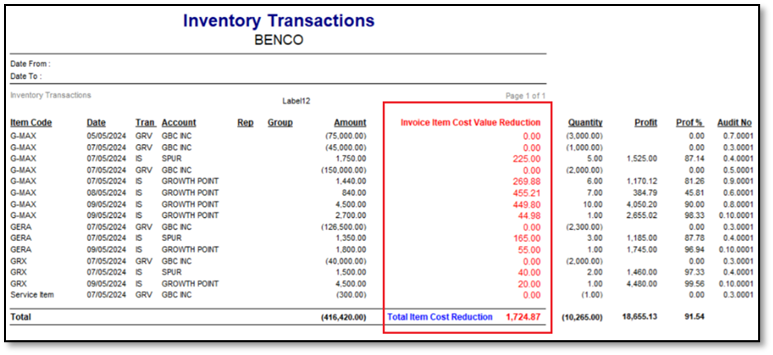

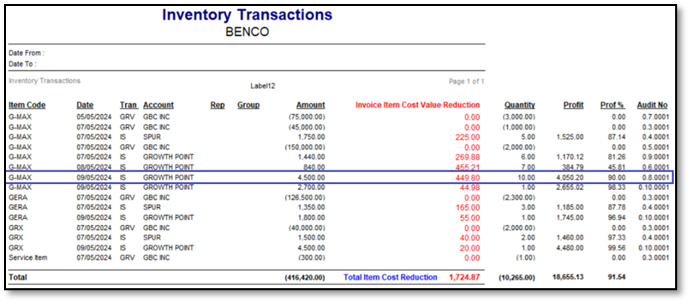

1. When you run the report, you should notice the new column (in red font below) and the report total value at the bottom.

2. Also, consider the following details to explain further:

In the above screen, notice that only the Invoice (unit reducing) transactions have a value. All GRVs (unit increasing) transactions have a zero value.

Refer to the R449.80 value below as an example:

In this case, the current Average Unit Cost of Item G-MAX was R44.98 just before the Sales Invoice was processed for 10 units.

Therefore: 10 x R44.98 = R449.80

Even if you back-date Invoices, it will always use the current Average Unit Cost value to calculate the above reduction of stock valuation.

The Unit Cost value:

• as used in the above report’s (red column) calculated values of back-dated invoices,

• are not affected by historical Average Unit Cost values,

• that were in existence on the relevant back-dated invoices’ transaction dates.